change the life of a child

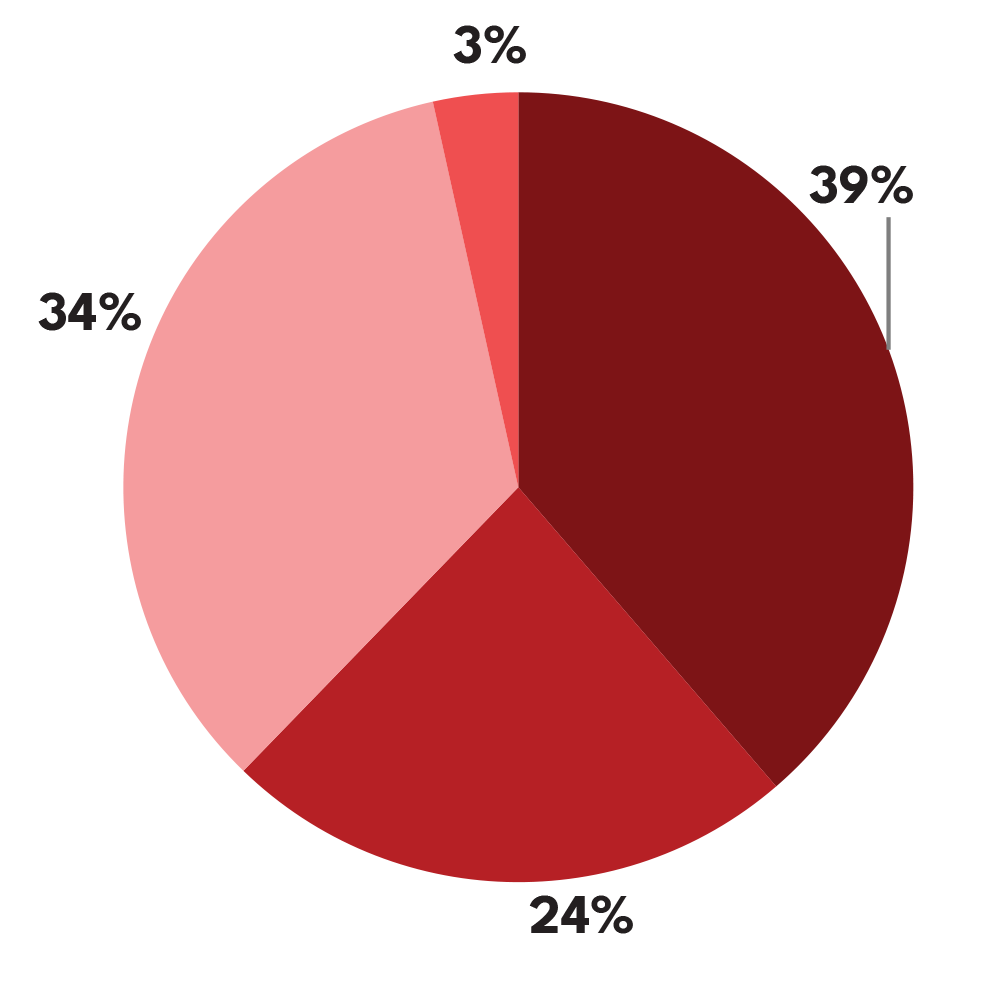

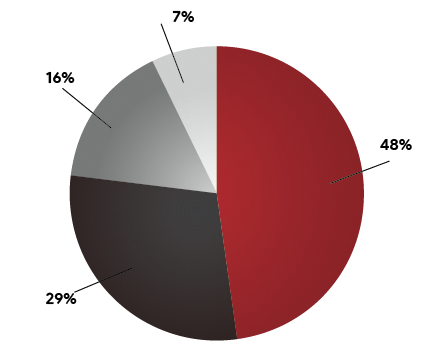

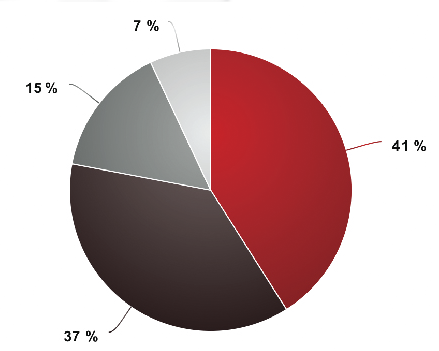

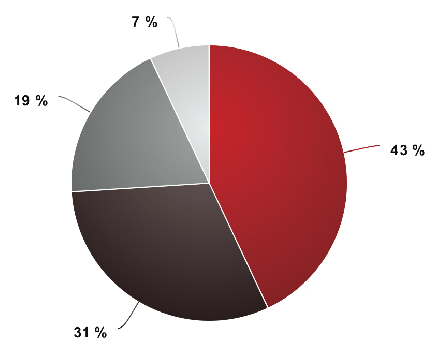

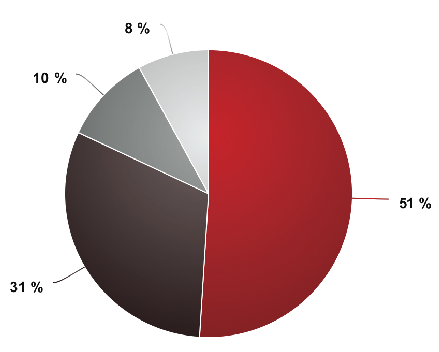

Fund Utilisation

FY 2020-21

FY 2019-20

FY 2018-19

FY 2017-18

FY 2016-17

Annual Reports

We are accountable to the wider public for the usage of funds received. Transparency and Accountability are our core value areas that we strive to bring to the fore at CSA. Every year, our children at supported Child Care Institutions aspire to know, learn and experience new things. Every year, we set a target to fulfill their dreams and desires. And every year, our donors and supporters play a significant role in helping us scale new heights. Our Annual Report is an amalgamation of the work done through the year, our achievements and proud moments, our audited finances and acknowledgement of different stakeholders involved.

Registrations

80G / 12A / FCRA and OTHERS

12A Certificate

12A registration is one time exemption obtained by most Trusts, right after incorporation to be exempted from paying income tax. Trusts and NGOs having 12A registration enjoy exemption from paying income tax on the surplus income of the Trust or NGO.

80G Certificate

Under the Income Tax Act, certain contributions or donations are eligible for a tax deduction under Section 80G. NGOs or other non-profits must apply for registration and are intensely scrutinized by the IT Department before being granted such a certification. This is because such institutions tend to attract a larger number of donations from corporates and individuals looking to give to charity while saving on tax.

CSA - Society Registration Certificate

FCRA stands for Foreign Contribution Regulation Act (FCRA) of 1976. NGOs need to have either prior permission or registration under FCRA, in order to receive donations and contribution in kind or currency from foreign sources.

CSA - Trust Registration Certificate

Society and Trust both are NGO/NPO. The difference between both is Society requires minimum 7 members in general body and all members have equal rights where as in Trust it requires minimum 2 Trustees only and there is no limitation for maximum trustees /members. Also all members have equal right except settler, authorized person have different power.